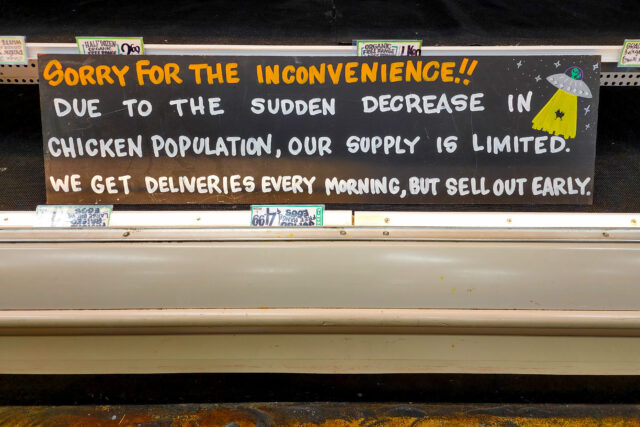

Food inflation is way worse than official, government data states if my local Aldi is a measure. The German-owned grocery was my favorite supermarket—until today’s visit. The many changes—higher costs among them—dismay and disappoint.

Aldi is about a 20-minute drive from our apartment, making it an expedition when other grocers are walking distance away. I hadn’t been to the place since sometime in 2023, although my wife has ventured there more recently. Today’s trip was my suggestion.